In the grand theatrical stage of Thai politics, a fascinating new act seems to be unfolding, one that involves the intricate dance of democracy, law, and the spirit of the Thai people. At the heart of this drama stands House Speaker Wan Muhamad Noor Matha, a distinguished figure who has recently voiced his support for a remarkable approach to steering the nation’s charter on a new course. In a move that has all the makings of a political thriller, the recommendation for not one, not two, but three referenda to amend the entire Thai charter has been backed. This suggestion comes from a study panel chaired by the astute Deputy Prime Minister and Commerce Minister Phumtham Wechayachai, whose collective wisdom sees this trio of referenda as the golden key to unlocking the door to constitutional amendment without the looming shadow of legal voidance by the Constitutional Court. Why the insistence…

THAI.NEWS - Thailand Breaking News

Last year, the hallowed halls of Thailand’s parliament were aflutter with the bustling energy of MPs and senators gathered for a meeting. Fast forward to today, and the air is thick with controversy. The reason? A series of expensive overseas jaunts planned by senators, all set to unfold as their term ticks down to its May 10 conclusion. The whispers and murmurs have grown into a chorus of outcry, spearheaded by none other than Plodprasop Suraswadi, a figure whose past life as a deputy prime minister imbues his words with a certain gravitas, alongside the famously candid Senator Seree Suwanpanont. At the heart of the uproar is a staggering 81 million baht earmarked for what some see as farewell tours. Suraswadi, peering through the lens of wisdom only years can bestow, questions the prudence of such travels with less than a month on the Senate’s clock. “Makes little sense,” he…

Imagine a scene where the central figure, Pita Limjaroenrat, clads himself in an armor of resilience, as his party – the Move Forward Party (MFP) – navigates through stormy seas, facing the threat of dissolution. The drama unfolds dramatically, akin to a blockbuster, with the MFP trapped in a narrative that could rival the twists and turns of a Shakespearean tragedy. At the heart of this saga lies a contentious battle over Section 112 of the Criminal Code, known as the lese majeste law. The MFP, bold and unyielding, sought to amend this, sparking a furious debate. Their efforts, however, were met with a stern rebuke from the Constitutional Court on Jan 31, branding their proposition as a perilous chisel threatening to sculpt away at the foundation of the constitutional monarchy. This ruling spiraled into a domino effect, leading the EC (Election Commission) to urge the charter court to contemplate…

In the bustling corridors of power, where whispers of political maneuvering often find fertile ground, Defence Minister Sutin Klungsang recently addressed the press with a demeanor that was as calm as a summer sea, despite the swirling rumors of his impending exit from the cabinet. It was on a bright Friday, after a Defence Council meeting, that Mr. Sutin tackled the speculation head-on, embodying the grace one might find in a seasoned diplomat rather than a minister under siege. “Life, much like politics, is replete with changes, and I am prepared to embrace whatever comes my way,” he declared, with a twinkle of resilience in his eye. For Mr. Sutin, the hint of his departure from the cabinet sparked not anger but introspection. He mused on the opportunity to demonstrate that civilians can navigate the defence helm as adeptly as their military counterparts, lamenting only the ticking clock that might…

In a bold move that seemed straight out of a high-octane crime series, Bangkok’s law enforcement descended upon the bustling streets near academic havens and serene communities, targeting the clandestine world of e-cigarette commerce. On an otherwise uneventful Friday, five shops, strategically nestled near the city’s universities and residential areas, found themselves at the heart of a police operation that was about to make headlines. The operation was spearheaded by none other than the esteemed Minister from the Prime Minister’s Office, Puangpet Chunlaiad, who, in a display of unwavering commitment to public health, joined forces with the vigilant team from the Office of the Consumer Protection Board (OCPB) and the dedicated officers of the Lat Phrao police station. Their target: the burgeoning but shadowy trade of e-cigarettes that had taken root in the neighborhoods of Lat Phrao and Ramkhamhaeng. The raid revealed a staggering stash of 10,000 e-cigarettes of every…

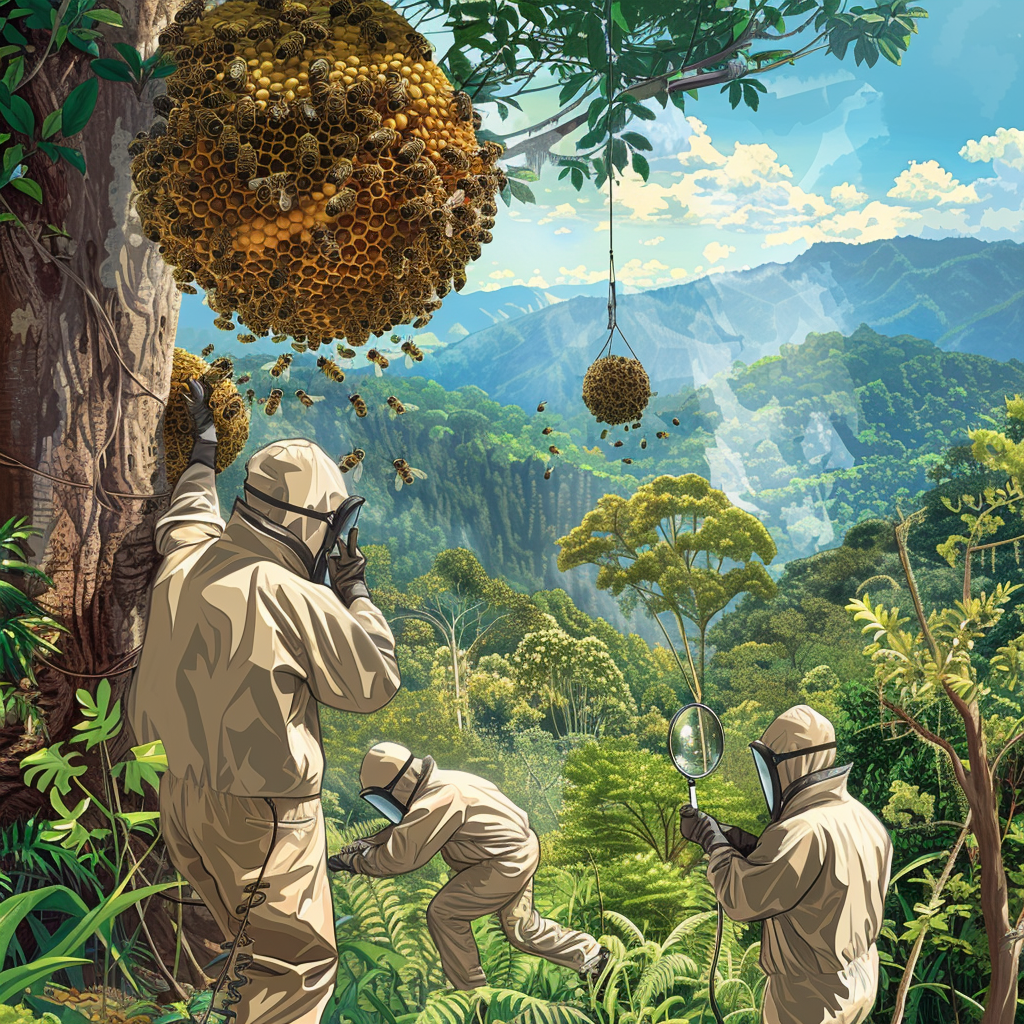

Imagine stumbling upon a creature so majestic, it feels like a myth come to life—this is exactly the thrilling experience a group of intrepid researchers from Chulalongkorn University had in the lush, verdant expanses of Doi Pha Hom Pok National Park, nestled in the picturesque province of Chiang Mai, Thailand. In an announcement that has the scientific community abuzz, the Department of National Parks, Wildlife and Plant Conservation, alongside these plucky biologists, unveiled the astonishing find of the Himalayan giant honey bee, a species long shrouded in mystery and awe. In an expedition filled with the promise of discovery, the researchers were initially on the trail of Kaiser-I-Hind, a rare and beautiful butterfly, when fortune smiled upon them in the most spectacular way. Amid the emerald canopy, they encountered a sight to behold—a swarm of colossal bees, resplendent with their stark black abdomens, crowns of golden fur, and wings that…

As the sun prepares to set on the term of the 250 senators handpicked by the junta’s National Council for Peace and Order (NCPO), a whirlwind of international travel is sweeping through their ranks. These aren’t your typical holiday jaunts, but rather a series of globe-trotting missions powered by a hefty 81 billion baht earmarked for fiscal year 2024, specifically for bilateral meetings and visits to countries far and wide. With the clock ticking down to their May 10 curtain call, some of these lawmakers are embarking on what could be their last acts of diplomatic outreach. Leading this worldwide odyssey is the committee on military affairs and state security, under the seasoned leadership of General Boonsrang Niumpradit. They’re set to traverse the scenic landscapes of Kazakhstan and Georgia from May 2 to 9, in what promises to be a fascinating blend of military discourse and cultural discovery. Not to…

In an astonishing sequence of events that sounds like it’s pulled straight from a high-octane thriller, two men have become the center of a gripping tale in Chiang Mai, proving that truth can indeed be stranger than fiction. Embarking on a daring heist that would have made professional bank robbers tip their hats in respect, these individuals managed to pilfer a staggering 76 million baht (which, for context, is the kind of money that could buy you a luxury yacht or a villa in some parts of the world) from a seemingly secure residence in the heart of Thailand’s northern jewel, Chiang Mai. The plot thickens with the arrest of the duo, Pudit and Adisak, whose ages are 39 and 45, respectively. Like characters straight out of a crime drama, they were nabbed by the authorities clutching the remains of their loot—a collection of jewelry and a whopping 37 million…

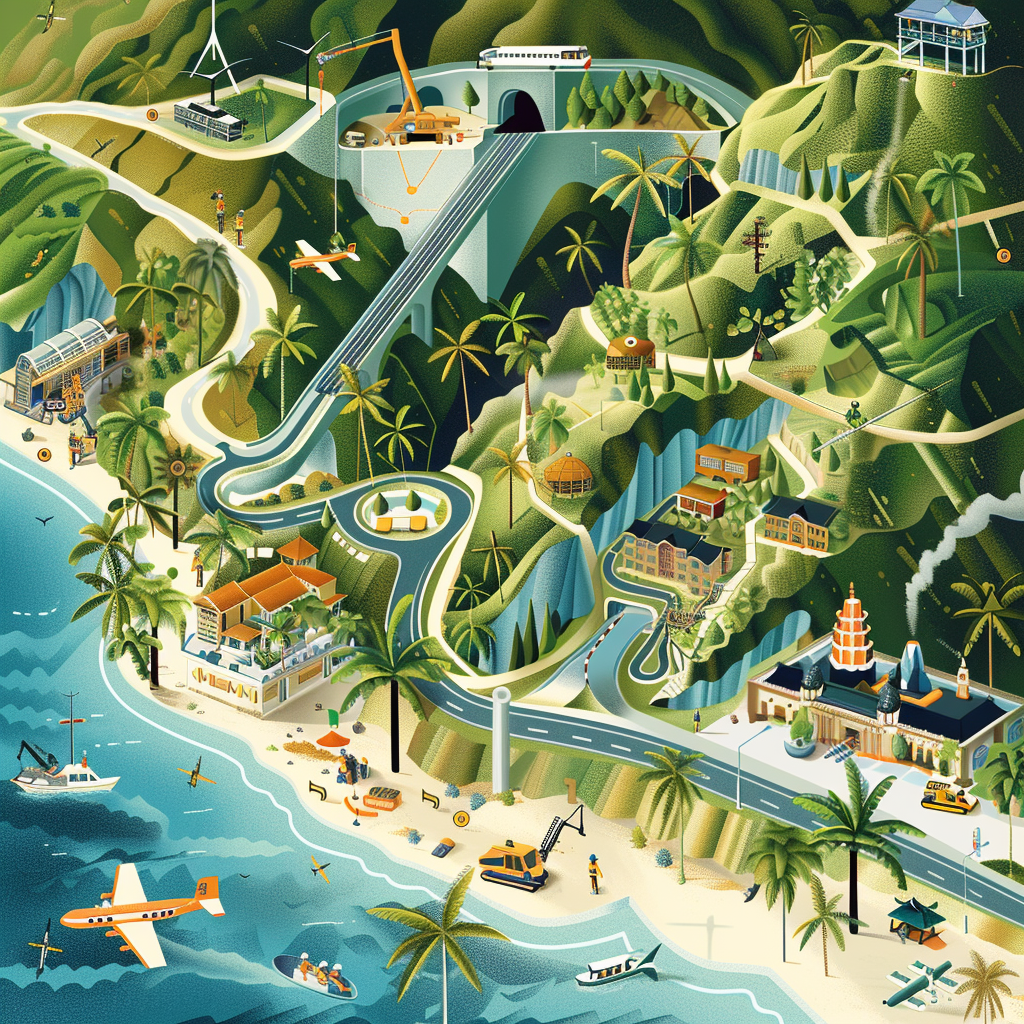

On a bright Friday in Phuket, Prime Minister Srettha Thavisin was in high spirits, mapping out a vision to transform the travel and tourism landscape of this tropical paradise. With an air of determination, he stood pointing towards the horizon where an ambitious elevated road is set to connect with Highway 4027, aiming to whisk travellers to the airport in Thalang district with unprecedented speed. The scene captured at Government House was not just a photo opportunity, it was a statement of intent. Gathered under the roof of Phuket International Airport, local authorities, alongside Prime Minister Srettha Thavisin, dived deep into conversation about construction plans destined to slice through the problematic traffic congestion that throttles the island. It was a congregation sparked by urgency, looking for ways to pump life back into the island’s vital tourism artery that has been strained by overcrowding on its roads. Transport Minister Suriya Jungrungreangkit…

In the sultry, neon-lit corners of Bangkok’s Silom area, a tale straight out of a noir thriller unfolded at the stroke of 10 p.m., in the opulent halls of a well-known hotel. The protagonist of our story, nothing less than a 45-year-old enigma, Sandra Christina, found herself ensnared by the long arm of the law. The drama that led to her apprehension could only be described as a web of accusations, international intrigue, and a hint of romance under the most unexpected circumstances. The spotlight turned to Sandra following a report from a titan in the world of Australian racehorse breeding. The accusation? A spine-tingling plot to kidnap a seven-year-old girl, with a chilling ransom demand set at 200 million baht. The motive behind this alleged cine-style crime was as murky as the waters of the Chao Phraya River at midnight. Authorities, piecing together this puzzling narrative, veered towards the…