Imagine strolling through the bustling streets of Bangkok, where the air is infused with the tantalizing aromas of street food and the hum of lively chatter fills the air. Now, envision this experience elevated by newly renovated sidewalks, a project spearheaded by the Bangkok Metropolitan Administration (BMA) to transform the way locals and tourists alike navigate the city’s vibrant thoroughfares. At the heart of this urban makeover is the BMA’s ambitious initiative to refurbish footpaths along 16 busy routes crisscrossing the capital. In an effort led by the effervescent BMA spokesman, Aekvarunyoo Amrapala, the administration recently kicked off an inspection tour, showcasing the ongoing work on Ratchadamri and Phloenchit roads. These pavements are getting a top-notch makeover to adhere to new durability and safety standards while embracing a universal design ethos for greater accessibility for all. Aekvarunyoo beams with pride as he explains the BMA’s master plan to revamp a…

THAI.NEWS - Thailand Breaking News

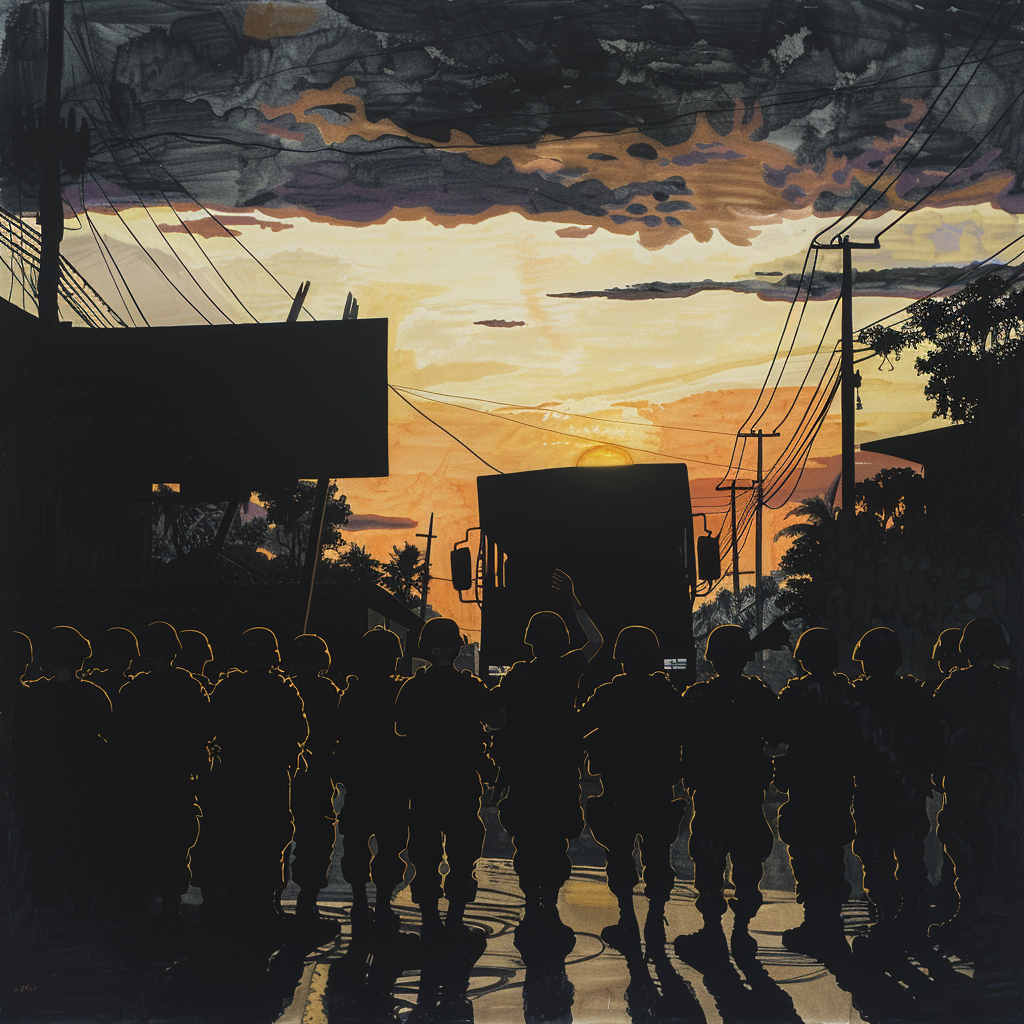

On a day that started like any other in the scenic, yet tumultuous south of Thailand, the peaceful facade of Narathiwat province was shattered, ushering in a narrative that would be etched in the annals of history with tragic ferocity. The date was October 25, 2004, a day that would forever be remembered for the events at Tak Bai, where fervor and desperation collided with an unyielding force, leading to a catastrophic aftermath that still resonates two decades later. It began with a rallying cry for justice. Hundreds of demonstrators gathered in front of the Tak Bai police station, their voices unified in protest, demanding the release of six detained defense volunteers. The air was thick with tension, anticipation, and a potent mix of hope and despair. These were not mere protesters; they were fathers, mothers, brothers, and sisters – a community banding together in pursuit of what they believed…

Imagine, if you will, a tale that unfolds not just on the bustling streets of Thailand but also crosses borders into the mysterious lands of Laos. This isn’t your run-of-the-mill story; it’s one that involves intrigue, mystery, and a dash of international drama. At the heart of this chilling saga are two Japanese gang members, their identities cloaked in mystery, suspected of a crime so heinous it sends shivers down the spine. Our narrative begins in the usually tranquil province of Nonthaburi, Thailand, where a gruesome discovery was made last month. A Japanese national met a fate most brutal, his body not just taken from this world but dismembered, leading the authorities on a macabre treasure hunt. This man, known among his circle as Ryosuke Kabashima, 47, was believed to be entwined in the shadowy dealings of a gang with nefarious intentions far beyond the borders of Thailand. The plot…

In a move that’s sent ripples across the media landscape, Voice TV, the brainchild of Panthongtae “Oak” Shinawatra, is set to pull the plug on its broadcasting operations across all platforms come the end of May. This decision marks the end of an era for a network that not only bore the Shinawatra family name but also carried a torch for a unique brand of journalism for 15 years. The shuttering of Voice TV means about 100 talented reporters and staff members are poised to bid adieu to what many considered a second home. Founded in the vibrant year of 2008 with a hefty purse of 300 million baht by none other than the offspring of former premier Thaksin Shinawatra, Voice TV burst onto the scene during a time when getting your news fix meant wrestling with a satellite TV setup. The media landscape back then was starkly different, and…

In the shadowy depths of the night, under the luminescent glow of the moon, Saba Yoi district in Songkhla became the stage of an audacious act of defiance. An armed individual, shrouded in black, loomed ominously at the threshold of Rungtiva Biomass Power Plant—a precursor to the chaos that was about to unfold. This was not a scene from a blockbuster movie, but the gritty reality captured on CCTV, setting the stage for an event that would rattle the stillness of the early hours. The curtain rose on this dramatic sequence as suspected insurgents orchestrated a calculated bomb attack on the power plant. It wasn’t just an isolated act of defiance; it was a choreographed show of power and protest that spanned neighboring districts. Just as the Rungtiva Biomass Power Plant in Plak Bo village was engulfed in turmoil, with three earth-shattering bangs piercing the calm after four shadowy figures…

In a riveting display of automotive excellence and historical prowess, Porsche Thailand, under the wing of AAS Group – the exclusive purveyors of Porsche’s dream machines in Thailand, rolled out the red carpet for none other than Mr. Alexander Fabig. Hailing from the heartland of Porsche in Germany, where the legacy of this iconic brand is woven into the very fabric of its culture, Mr. Fabig graces his title as the Vice President of Individualisation and Classic at Porsche with unmistakable passion and a wealth of expertise in the realm of classic Porsches. The stage was set by Mr. Peter Rohwer, the Managing Director of Porsche Thailand by AAS Group, who expertly orchestrated this symposium of time-honored tradition and innovation. As the conversation unfurled, Mr. Fabig took attendees on a mesmerizing journey through Porsche’s illustrious history, with anecdotes and insights spanning from the humble yet profound impact of the Porsche…

Imagine stepping into a world where architecture isn’t just about buildings, but a language that transcends borders, inviting architects and designers from every corner of the globe to speak in a unified voice. This is the vision behind the “Architect’24 Expo”, an event that’s setting the stage in the heart of ASEAN for a pivotal gathering under the vibrant theme, Collective Language: Sensing Architecture. Ready to unravel the largest showcase of design and construction wonders? Span your imaginations across 75,000 sqm at the sprawling IMPACT Exhibition and Convention Center in Muang Thong Thani, from the last leap of April into the budding days of May 2024. But why all the buzz about this expo, you ask? Beyond its sheer scale, the ASA International Forum is the jewel in its crown, promising an influx of architectural maestro from the world over, congregating to dive deep into “Critical Regionalism in Architecture”. The…

In the rapidly transforming financial landscape of Thailand, a shining beacon of innovation and customer-centricity has emerged, catching the eye of industry onlookers and clientele alike. TMBThanachart Bank Public Company Limited, affectionately known as ttb, has etched its name into the annals of digital banking history by clinching the coveted Digital Banking Services of the Year Award at the prestigious Thailand Top Company Awards 2024. The award, a collaborative effort between BUSINESS+ magazine and the University of the Thai Chamber of Commerce, celebrates organizations that are at the forefront of digital financial excellence. Ttb’s recent triumph is not just a trophy in their cabinet but a testament to their relentless pursuit of digital transformation and improving the financial well-being of their customers, today and in the years to come. Mr. Naris Aruksakunwong, the visionary Chief Strategy and Digital Group and the acting Head of ttb Spark, has been at the…

In the sun-drenched, bustling province of Khon Kaen, a tale unfolded that could easily be mistaken for a high-octane movie plot. At the heart of the drama was Ratchaphon Khiannok, a 35-year-old with a dubious distinction on his resume—convicted drug offender. Alongside his spry 20-year-old sidekick, Palangwatchara Khunsinchairat, Ratchaphon’s latest escapade came to a crashing halt at a seemingly peaceful resort, painting a picture of crime and desperation that few fiction writers could conjure. Our saga begins with Ratchaphon, freshly slapped with a verdict on drug charges, making a daring daylight escape from the clutches of the law. With the sort of audacity that leaves onlookers agape, he shimmied over the court’s fence, fetters clanking with every movement, to a getaway motorcycle manned by none other than his loyal accomplice, Palangwatchara. The duo’s flight from justice led them to the comforting confines of a relative’s home where they sought refuge…

In an emotionally charged scene reminiscent of a stand against historical injustices, families, their hearts heavy with years of grief and eyes ablaze with a demand for justice, stood outside the Narathiwat Provincial Court. Their banners, more than mere pieces of fabric, were powerful symbols of the enduring quest for justice regarding the harrowing Tak Bai massacre. This tableau unfolded in the south of Thailand, a region whose beauty and tranquility belie a history of turmoil and suffering, particularly that cold day in October 2004 which has etched itself indelibly into the collective memory of the people of Tak Bai. Thursday brought an air of grim determination as injured protestors and grieving families, still haunted by the specter of that fateful day’s tragedy, took a monumental step. They brought forth a lawsuit against nine individuals who once stood at the zenith of power in southern Thailand. These former officials, accused…