As the sun prepares to set on the term of the 250 senators handpicked by the junta’s National Council for Peace and Order (NCPO), a whirlwind of international travel is sweeping through their ranks. These aren’t your typical holiday jaunts, but rather a series of globe-trotting missions powered by a hefty 81 billion baht earmarked for fiscal year 2024, specifically for bilateral meetings and visits to countries far and wide. With the clock ticking down to their May 10 curtain call, some of these lawmakers are embarking on what could be their last acts of diplomatic outreach. Leading this worldwide odyssey is the committee on military affairs and state security, under the seasoned leadership of General Boonsrang Niumpradit. They’re set to traverse the scenic landscapes of Kazakhstan and Georgia from May 2 to 9, in what promises to be a fascinating blend of military discourse and cultural discovery. Not to…

THAI.NEWS - Thailand Breaking News

In an astonishing sequence of events that sounds like it’s pulled straight from a high-octane thriller, two men have become the center of a gripping tale in Chiang Mai, proving that truth can indeed be stranger than fiction. Embarking on a daring heist that would have made professional bank robbers tip their hats in respect, these individuals managed to pilfer a staggering 76 million baht (which, for context, is the kind of money that could buy you a luxury yacht or a villa in some parts of the world) from a seemingly secure residence in the heart of Thailand’s northern jewel, Chiang Mai. The plot thickens with the arrest of the duo, Pudit and Adisak, whose ages are 39 and 45, respectively. Like characters straight out of a crime drama, they were nabbed by the authorities clutching the remains of their loot—a collection of jewelry and a whopping 37 million…

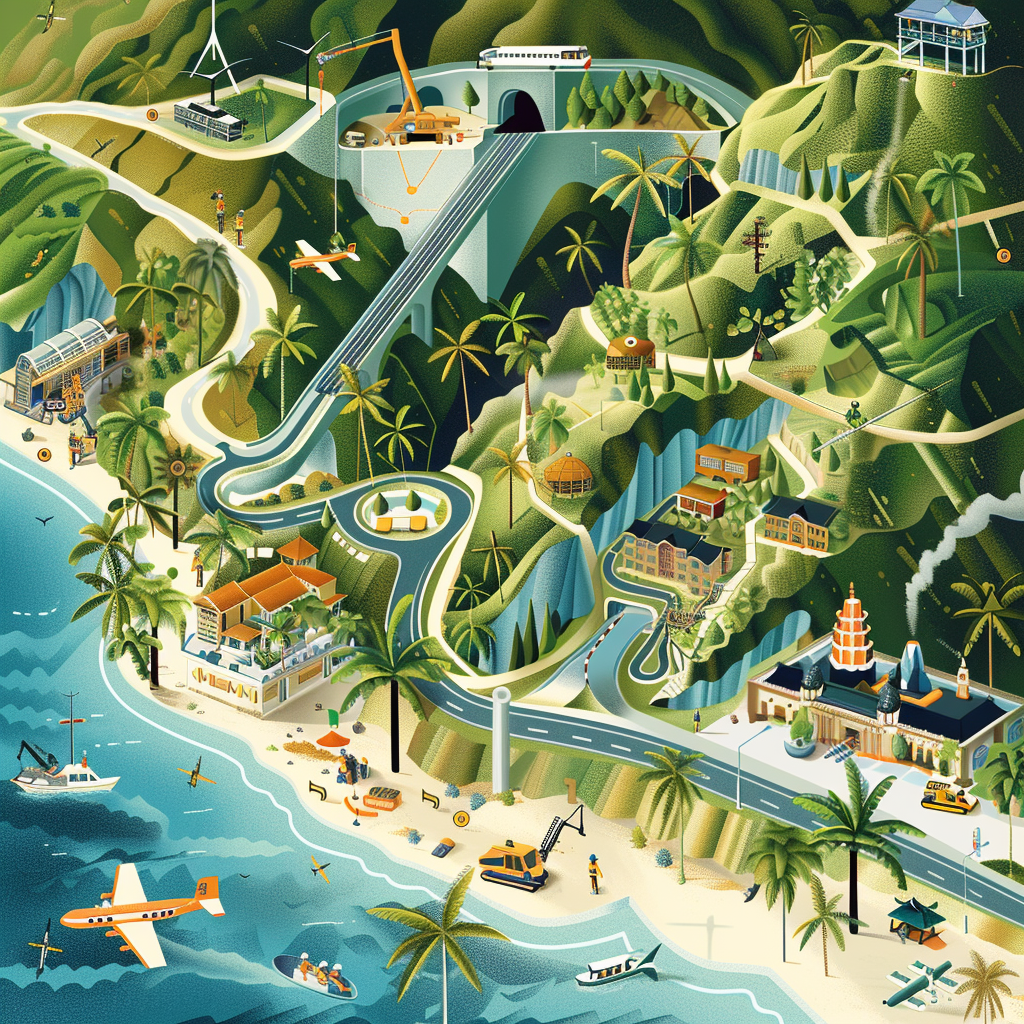

On a bright Friday in Phuket, Prime Minister Srettha Thavisin was in high spirits, mapping out a vision to transform the travel and tourism landscape of this tropical paradise. With an air of determination, he stood pointing towards the horizon where an ambitious elevated road is set to connect with Highway 4027, aiming to whisk travellers to the airport in Thalang district with unprecedented speed. The scene captured at Government House was not just a photo opportunity, it was a statement of intent. Gathered under the roof of Phuket International Airport, local authorities, alongside Prime Minister Srettha Thavisin, dived deep into conversation about construction plans destined to slice through the problematic traffic congestion that throttles the island. It was a congregation sparked by urgency, looking for ways to pump life back into the island’s vital tourism artery that has been strained by overcrowding on its roads. Transport Minister Suriya Jungrungreangkit…

In the sultry, neon-lit corners of Bangkok’s Silom area, a tale straight out of a noir thriller unfolded at the stroke of 10 p.m., in the opulent halls of a well-known hotel. The protagonist of our story, nothing less than a 45-year-old enigma, Sandra Christina, found herself ensnared by the long arm of the law. The drama that led to her apprehension could only be described as a web of accusations, international intrigue, and a hint of romance under the most unexpected circumstances. The spotlight turned to Sandra following a report from a titan in the world of Australian racehorse breeding. The accusation? A spine-tingling plot to kidnap a seven-year-old girl, with a chilling ransom demand set at 200 million baht. The motive behind this alleged cine-style crime was as murky as the waters of the Chao Phraya River at midnight. Authorities, piecing together this puzzling narrative, veered towards the…

In the gently swaying palms of Chaiya district, Surat Thani, a tale as heart-wrenching as it is bewildering unfolded on a rather unassuming Friday morning. Picture this: a tower piercing the sky, a man perched precariously at its zenith, and a community suspended in a collective gasp. This is not the opening scene of a thriller novel, but the tragic reality that played out in the southern province of Thailand. The central figure of our story, a 49-year-old man of Polish descent, found himself in a dire standoff with gravity atop a cellular tower. Eyewitnesses, initially unsure of what they were witnessing, soon realized the gravity of the situation. As the news spread like wildfire, police and rescue units converged on the site located seductively by Highway 41, mere steps from the Chaiya intersection. Pol Capt Danai Chanklan, the deputy investigation chief at Chaiya police station, pieced together the events…

In a narrative seemingly plucked from the pages of a high-octane thriller, yet squarely rooted in the heart of Bangkok’s bustling streets, Panich Promphat, son of the venerated Deputy Minister of Public Health, Santi Promphat, found himself embroiled in a story that veers wildly between rebellion and redemption. As the clock struck 3:30 am on a fateful Thursday, Panich, behind the wheel of a BMW i8—a marvel of engineering valued at a whopping 11.8 million baht—faced an unexpected turn of events that would lead to an explosive encounter with law and order. This tale unfolds on Ratchadaphisek Road, in the shadowy confines of Chatuchak district, where a routine police checkpoint awaited unsuspecting motorists. There, officers stood vigilant, their eyes peeling for signs of wrongdoing, as they embarked on their nightly quest to sieve the reckless from the responsible in a bid to curb the perennial menace of drunk driving. It…

In the swirling vortex of political whispers that recently gripped the nation, a resounding voice sought to cut through the noise. It was none other than Phumtham Wechayachai, a key figure whose words carry the weight of decades spent in the political arena. Addressing the whirlwind of rumors with a level of calm assurance only a seasoned politician could muster, Phumtham set the record straight on the matter of selecting the prestigious position of the speaker of the House. “The power to designate the speaker,” Phumtham began, his tone both firm and enlightening, “is a prerogative vested in the lower House and Parliament. It is not, contrary to popular belief, a decision influenced by any single political party or government faction.” This declaration wasn’t just a clarification; it was an education for the public on the workings of their democracy. Amidst the sea of speculation that has surrounded the coveted…

In the serene province of Buri Ram, a tale as unexpected as it is poignant unfolded, gripping the hearts of the local community. The story revolves around Yingphan Wongwai, a 48-year-old native whose recount of an unusual funeral service captivated everyone’s attention. It was a somber gathering, shadowed by the tragic loss of a man who had taken his own life. Given the state of the deceased’s body, which had begun to show signs of decay, the grieving family opted for a closed casket service, bracing themselves for a farewell devoid of one last glance at their loved one. Amid the sorrow, a glimmer of hope and compassion emerged in the form of a graceful Taiwanese woman. Enter Chou Yi Hua – or Emma, as she prefers to be called – a 33-year-old mortuary cosmetologist with a golden heart. With four years of experience under her belt back in Taiwan,…

In an era where blending technology and traditional agriculture seems to be the magic formula for economic revitalization, Thailand is taking bold steps with its 500-billion-baht digital wallet scheme. Designed by the digital wallet committee and announced last week, it seems like the key to unlocking a prosperous future for 17 million Thai farmers. This ambitious plan is fueled by a hefty loan of 172.3 billion baht from the bank, a figure that’s more than just a number—it’s a beacon of hope for growth and sustainability. However, the road to financial revolution is not without its hurdles. The bank finds itself in a precarious position, awaiting government compensation totaling a staggering 619 billion baht for previously delivered state aid to farmers. Their liquidity lingers at around 200 billion baht, a sum that whispers caution into the winds of change. This juxtaposition of financial strategy and uncertainty has sparked lively debate…

In the heart of Bangkok, under the cover of night, a tale straight from a cinematic thriller unfolded at a posh hotel in the bustling Silom district. The city, known for its vibrant streets and neon-lit skylines, became the backdrop for an audacious plot that seemed to leap from the pages of a crime novel. Enter Sandra Christina Marie Diersten, a 45-year-old Frenchwoman with a mysterious past, who found herself enveloped in a swirling vortex of accusations, conspiracy, and a high-stakes ransom demand. The stage was set on a sultry Thursday evening when Metropolitan Police Bureau (MPB) officers swooped in to arrest Diersten at around 10 pm, unraveling a plot that could perplex even the keenest of minds. The charge? Orchestrating a nefarious scheme to kidnap the seven-year-old daughter of a Thai business magnate, with a jaw-dropping ransom demand of 200 million baht hanging in the balance. The script seemed…