In an unprecedented twist of events that seems ripped from the pages of a corporate thriller, Jessada Kengrungruangchai, the director at the helm of J & B Metal Co Ltd, found himself navigating through a murky quagmire of legal and environmental responsibilities. In a bustling Samut Sakhon, a province known for its industrious spirit, Jessada, alongside his legal counsel, marched into the police station to confront a storm of charges related to the possession of cadmium waste within his company’s storage facilities. The plot thickens as Jessada, along with his wife, both directors of the beleaguered company, earnestly requested to peel through the layers of information, complaints, and charges mounted against them. This wasn’t merely a quest for clarity but a bid to craft a defense as resilient as the metals they dealt with. In their narrative, the cadmium waste, a villain in this saga, was not a sinister stockpile…

THAI.NEWS - Thailand Breaking News

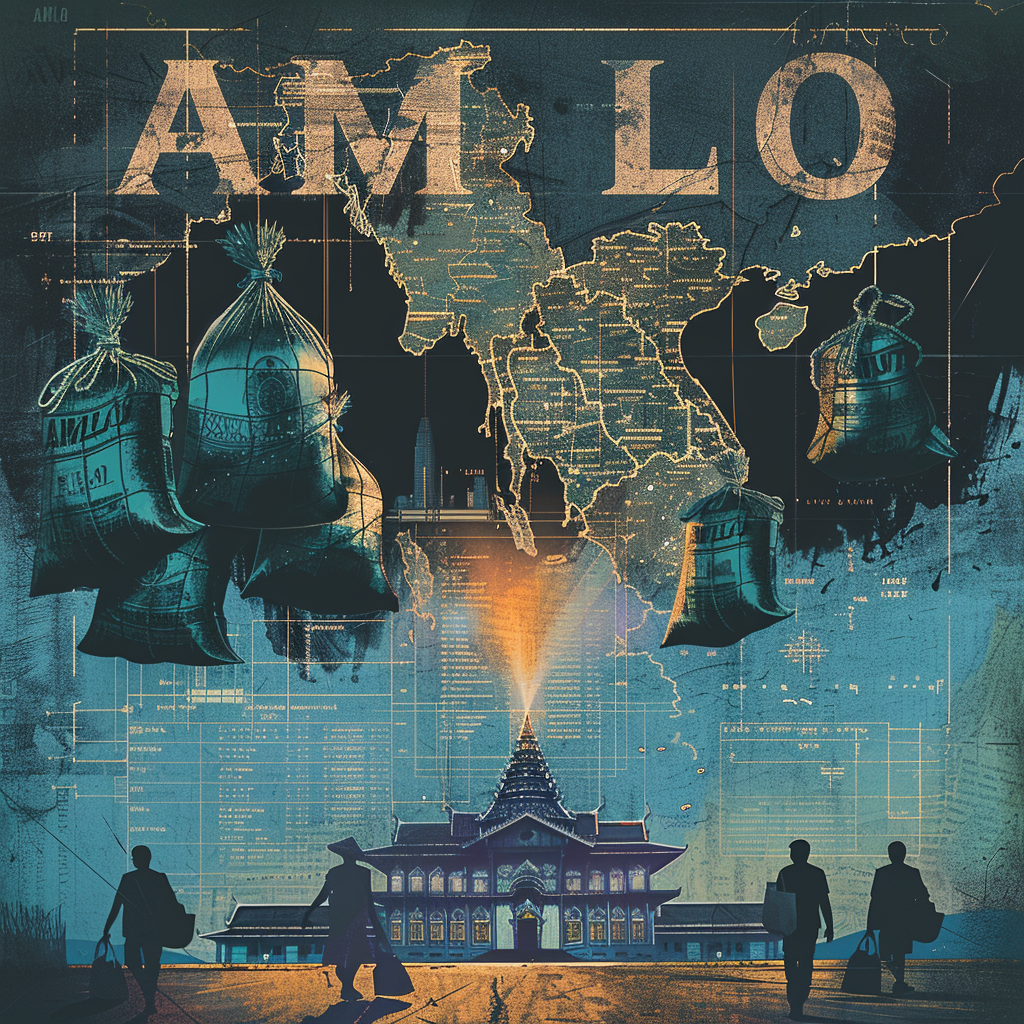

In a daring narrative that sounds more like a plot from a high-stakes thriller than a page from a governmental report, Minister of Digital Economy and Society Prasert Chantararuangthong unfolds the tale of Thailand’s relentless pursuit of call-centre scammers. Since 2021, the government has been on a mission, not just to apprehend the digital-age bandits but to right their wrongs, transforming victims into victors in the process. At the heart of this crusade is the Anti-Money Laundering Office (AMLO), which, armed with regulatory prowess and investigative acumen, has managed to seize a staggering 6 billion baht in cold hard cash. When you add in the value of real estate and other assets, the bounty balloons to an impressive 10 billion baht. But here’s where the plot thickens: this treasure trove isn’t destined to gather dust in the vaults of the state. In an unprecedented move, a portion of these ill-gotten…

Welcome to the dazzling, drenched world of Songkran Festival 2024, Thailand’s most epic water festival, where splashing water isn’t just fun—it’s a nationwide sport! Imagine streets brimming with laughter, vibrant processions, and the joyous chaos of water fights. This year, the festival wasn’t just confined to small pockets; it was a grand spectacle witnessed across all provinces, drawing in a jubilant crowd of both locals and international tourists ready to dive into the fun. As night fell, the festivities only ramped up. From the heart of Bangkok to the far reaches of the provinces, the air buzzed with excitement and the promise of unforgettable nighttime shenanigans. Speaking of Bangkok, the city saw a whopping 19% spike in outbound travel. Seems like everyone was itching to escape the concrete jungle for some festive fun. Yet, amidst this exodus, Bangkok held its title as the data consumption champion. True Corporation, in its…

In a twist that could rival the plot of a prime-time drama, Pol Gen Surachate Hakparn, known colloquially as ‘Big Joke’, found himself navigating the murky waters of a money laundering accusation. The narrative began to unfold on the 2nd of April when Surachate, in a move that was both a spectacle and a statement, made his way to the police station to face charges tied to the laundering of ill-gotten gains. However, our protagonist would not spend his nights behind bars; he was swiftly released on bail, leaving the public to speculate on the next episode of this enthralling saga. The plot thickened as the acting national police chief, taking decisive action that would make any prime-time suspense drama proud, suspended deputy chief Surachate and a quartet of subordinates. This dramatic turn of events was rooted in allegations tied to their involvement with an illicit online gambling network by…

Imagine stepping aboard a sleek, futuristic train, zipping across picturesque landscapes at breathtaking speeds straight out of a science fiction novel. This is no mere daydream for Thailand, as it marches towards realizing the dream of a high-speed railway connecting bustling Bangkok with the charming city of Nakhon Ratchasima. A dazzling display model caught the eyes of many back in 2017, setting hearts racing with anticipation. Yet, like the plot of a gripping thriller, the journey to its completion is filled with suspense, now with a new finish line drawn for 2028. The State Railway of Thailand (SRT) is on the cusp of a significant milestone, with Deputy Transport Minister Surapong Piyachote hinting at the imminent signing of the final two construction contracts. Spanning an impressive 251 kilometers and boasting an investment of 179.4 billion baht, this grand project promises to redefine travel in the Land of Smiles. Out of…

It was a scene rich with political intrigue and hesitant smiles. Picture this: it’s not your usual humdrum Thursday; instead, we’re caught up in a whirlwind of speculation, whispers of change, and the unmistakable air of suspense that only political corridors can brew. At the heart of it all? None other than our Prime Minister, Srettha, who only days before had firmly shut down any whispers that he’d take on the mantle of overseeing the Defence Ministry. But oh, what a difference a day, or in this case, two days, can make. The same question that had once received a categorical ‘no’ was now met with a smile, as enigmatic as the Mona Lisa’s. “At this second, I’m still the prime minister and finance minister,” Srettha declared, his words hanging in the air, a tantalizing hint at possible shifts on the political chessboard. There’s an art to speaking to reporters…

Imagine stepping into the vibrant heart of Bangkok, where the pulse of the city beats in sync with the steady rhythm of electric trains gliding along their tracks. A bustling metropolis known for its rich tapestry of culture, tantalizing street food, and the ever-charming hustle and bustle, now on the brink of a revolutionary travel metamorphosis. This isn’t just about getting from point A to point B; it’s about redefining urban mobility, spearheaded by an announcement that sparked conversations and dreams alike—a 20-baht flat-fare spectacle, illuminating the horizon with its bold promise. In the sprawling expanse of Bangkok’s Krung Thep Aphiwat Central Terminal, a beacon of hope made its presence known in October last year. A simple sign, yet a profound declaration: “20-baht travels on the Red Line.” A preview of what could redefine the urban commute, making the city’s pulse more accessible to everyone. But the ambition doesn’t stop…

In a captivating turn of events that reads like a thriller novel, Jetsada Kengrungruangchai, the enigmatic director of J&B Metal Co, found himself in a rather precarious situation. The scene unfolded on a seemingly ordinary Thursday, within the stark walls of the police Natural Resources and Environmental Crime Suppression Division, where Jetsada, with a stern expression, was flanked by authorities and flashing cameras. The reason? A whopping 13,800 tonnes of cadmium tailings, a substance as dangerous as it sounds, discovered sprawled across various locations in Thailand, from the bustling streets of Bangkok to the industrial heartlands of Samut Sakhon, and even the picturesque shores of Chon Buri. This hazardous adventure began when J&B Metal, under Jetsada’s direction, ventured into the murky waters of hazardous waste management, purchasing cadmium waste from a landfill nestled in the verdant province of Tak. Cadmium, known for its starring role in the manufacture of rechargeable…

In the grand theatre of air travel, where the world’s airports are the magnificent stages on which the drama of international voyages unfolds, the plot thickens year by year as these transportation hubs vie for the coveted titles bestowed by Skytrax. The year 2022 saw Hamad International Airport in Doha, Qatar, basking in the limelight, proudly holding the title of the crown jewel in the realm of airports. Yet, as with any great drama, the throne was destined for a new monarch. The following year, the crown passed to Singapore’s Changi Airport, a haven of tranquility and innovation, proving yet again that in the world of aviation, fortunes can shift as swiftly as the winds. As we peel back the curtain on Skytrax’s prestigious list for this year, we encounter a pantheon of high-flying sanctuaries that transcend the mundane to offer something magical. Let’s embark on a journey through these…

Imagine stumbling upon a modern-day treasure hunt, but instead of gold or jewels, the bounty is 13,000 tonnes of cadmium waste—far from glamorous, yet intriguingly hazardous. This tale begins in the serene district of Muang in Tak, where a seemingly dormant site, previously operated by the enigmatic Bound and Beyond Plc, has sparked an environmental thriller that could rival any blockbuster movie. The company, having ceased operations years ago, left behind a legacy not many would envy—a vast quantity of cadmium waste, long buried and forgotten, until now. Our story unfolds with officials unraveling this grim treasure map, only to discover that the stash had been craftily relocated. The journey to trace the waste led them to an unsuspecting factory in the bustling province of Samut Sakhon, housing a mere fraction of the loot—2,500 tonnes of cadmium. This factory, akin to a magician in a circus, had performed a disappearing…